LLP Registration Consultant

Welcome to our dedicated LLP Registration Consultancy, your trusted partner for seamless Limited Liability Partnership formation solutions nationwide. From inception to establishment, we offer tailored assistance to ensure a hassle-free experience. Dive into the core essence of LLPs with us, exploring their features, benefits, essential documentation, fees, and procedural steps. Whether you prefer online guidance or offline consultation, our expert team stands ready to assist at every turn. As your committed LLP Registration Consultant, we simplify the complex, making your registration process smooth and effortless. Entrust us with your LLP journey, and let’s navigate the intricacies together, ensuring compliance and success every step of the way.

Looking for LLP Registration Consultant?

Limited Liability Partnership Registration

Welcome to our definitive guide on Limited Liability Partnership (LLP) Registration. Here, we unravel the complexities of establishing an LLP under the regulatory framework of the Limited Liability Partnership Act, 2008. LLPs, distinguished as separate legal entities, mandate a minimum of two designated partners, granting personal asset protection while retaining liability for misconduct. Renowned for their adaptable management structures and tax advantages, LLPs emerge as highly beneficial business entities. Oversight of LLP registration falls under the purview of the Ministry of Corporate Affairs, facilitated through the Registrar of Companies, with efficient online procedures in place. As seasoned LLP registration consultants, we specialize in expediting the establishment process, typically achieving LLP formation within a mere 4 days, ensuring full compliance with regulatory mandates at every stage.

Scenarios Where LLP Registration is beneficial

LLP registration offers numerous advantages across various business landscapes:

Professional Services: Lawyers, accountants, architects, and consultants opt for LLPs due to easy management and asset protection.

Small and Medium Enterprises (SMEs): Startups and small businesses favor LLPs for partnership benefits alongside limited liability, easing access to funds for growth.

Family Businesses: LLPs offer a structured approach for family-owned businesses, ensuring smooth succession planning.

Joint Ventures: LLPs facilitate clear responsibilities and profit-sharing arrangements for collaborative projects.

Professional Collaborations: Professionals from diverse fields utilize LLPs for resource sharing and fair profit distribution.

Tech Startups and Innovators: Quick setup and flexible ownership division make LLPs attractive for tech ventures, fostering innovation.

Real Estate Ventures: Property developers and investors mitigate risks through LLPs, safeguarding personal finances.

In summary, LLP registration provides a versatile and secure framework for businesses, ensuring legal protection and operational efficiency in various scenarios.

What are the minimum requirement for LLP Registration?

To set up a new LLP in India, you need to meet these requirements:

1. Minimum of Two Partners: You must have at least two partners to start an LLP. These partners work together to run the business.

2. Designated Partners: The LLP must have at least two designated partners who are responsible for making sure the LLP follows all the rules and regulations. They handle compliance and day-to-day operations.

3. Unique Name Ending with “LLP”: The name you choose for your LLP must be one-of-a-kind and must end with the abbreviation “LLP” to show that it’s a Limited Liability Partnership.

4. Compliance with LLP Rules: It’s essential to follow all the LLP rules, including filing necessary documents with the Registrar of Companies (ROC), to keep your LLP in good standing with the law.

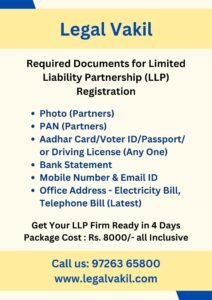

What are the Documents Required for LLP Registration?

Following Documents required for LLP Registration Process

- PAN Card of Partners

- Aadhar Card of Partners

- Bank Statement of Partners

- Photo of Partners

- Mobile and Email id

- LLP Address – Electricity Bill (Latest) (With Owner NOC)

Our LLP Registration Consultancy Package @8000/-

We are nearest LLP Registration Consultant, Our Package Includes

- LLP Registration

- Government Fees and Stamping

- Notarization of LLP Deed

- DIN x 2 Partner

- DSC x 2 Partner

- PAN Card

- TAN Card

- Form 3 Filing

- MSME Registration

- PF-ESIC Registration (if Required)

Process of LLP Registration in India - Get LLP in 4 Days

Limited Liability Partnership Formation is an Easy and Smooth Process, and the LLP can be formed in Four Days. Here is the step-by-step process of registration:

Step 1: Decide on a Unique LLP Name and Name must ends with LLP.

Step 2: Fulfillment of LLP required Documents.

Step 3: Signing of Declaration and NOC (Softcopy/Remote Signing Process).

Step 4: Filing of Online Registration Form Via MCA Portal.

Step 5: Certificate of Registration (LLPIN) and Preparation of LLP Deed and Filing of Form 3.

Step 6: Opening of Bank Account, Start Business Activity

Who Can be a Partner in LLP?

Partners in an LLP can vary widely:

Individuals: Professionals like doctors, lawyers, and engineers contribute skills, knowledge, and funds.

Companies: Corporations or limited companies bring assets, finances, or specialized services.

Foreigners: Including non-resident Indians (NRIs), adhering to foreign investment regulations.

Unlimited Liability Partners: Rare cases exist where partners have full personal liability.

Designated Partners: Mandated for legal compliance and management, with at least one residing in India.

In summary, LLP partners encompass individuals, companies, foreigners, and may have varying liability levels, all crucial to business operations.

FAQ's on Limited Liability Partnership Formation

Yes, Home Address can be used for LLP Registration.

We are available across India for LLP Registration.

- An LLP is a business structure that combines elements of partnerships and corporations. It provides limited liability to its partners while allowing flexibility in management and taxation benefits.

- A minimum of two designated partners is required to form an LLP. There is no restriction on the maximum number of partners.

- The steps typically involve selecting a suitable name for the LLP, drafting and filing the LLP agreement, obtaining Digital Signature Certificates (DSC) and Designated Partner Identification Numbers (DPIN), and filing the incorporation documents with the Ministry of Corporate Affairs (MCA).

- Documents such as identity proof, address proof, and PAN card of partners, LLP agreement, and address proof of the registered office are required for LLP formation.