Section 8 Company Consultant

We are specialize Section 8 Company Consultant, offering tailored services to suit your NGO Requirements and needs. From the conceptualization of your Section 8 Company to its official establishment, we provide comprehensive solutions across India. Our expertise spans every aspect of Section 8 Company registration, ensuring a seamless journey from beginning to end.

Explore the essence of Section 8 Companies, their unique characteristics, benefits, and the essential documents required for registration. We walk you through the entire registration process, from the initial consultation to the final setup, ensuring adherence to all regulatory standards.

Connect with us for a stress-free Section 8 Company registration experience. Our services are personalized to accommodate your specific preferences, whether you seek online assistance or prefer in-person consultancy. Rest assured, we are committed to supporting you at every stage of the registration process, guaranteeing a smooth and effective experience.

Interested in Section 8 Company Registration?

Section 8 Company Formation

Under the rules established by the Companies Act of 2013, Section 8 Company registration is governed. Section 8 Companies, also known as non-profit organizations, are formed with the primary objective of promoting charitable causes, arts, science, religion, education, sports, social welfare, research, or similar endeavors. These companies do not distribute profits among their members and instead reinvest any surplus funds towards achieving their stated objectives.

The Ministry of Corporate Affairs (MCA) oversees Section 8 Company registration processes and regulations through the Office of Registrar of Companies (ROC). Registration procedures are streamlined and can be completed entirely online, eliminating the need for physical document submissions.

Setting up a Section 8 Company is a breeze. You need at least two members and two directors, with one being an Indian citizen. The company’s name must include words like Foundation, Association, Federation, Chamber, Forum, Council, Electoral Trust, or others that hint at its charitable or social welfare focus.

NGO registrations are on the rise as the economy grows, leading to more charitable and community-building activities. A Section 8 Company channels its funds for the betterment of society, ensuring any surplus is redirected for social welfare purposes only. From a tax perspective, Section 8 companies enjoy benefits. Profits used for charitable purposes are tax-exempt under Section 12AA of The Income Tax Act. This encourages more organizations to contribute positively to society without worrying about hefty tax burdens.

As experienced Section 8 Company Consultant, We provide registration hassle free. We specialize in facilitating swift registrations in India. With our expertise, your Section 8 Company can be established efficiently, typically within a timeframe of just a few days. We ensure a smooth process while adhering to all regulatory requirements.

Scenarios Where Section 8 Company Registration is Advisable

Section 8 Company registration is recommended for initiatives focusing on charitable causes, education, research, culture, healthcare, environment, social welfare, and religion. Here’s why:

- Charitable Organizations: Ideal for those aiding the less fortunate.

- Educational Institutions: Perfect for setting up schools or colleges for the underprivileged.

- Research and Development: Great for scientific innovation and addressing societal challenges.

- Cultural Promotion: Supports preservation and promotion of cultural heritage.

- Healthcare Initiatives: Facilitates affordable healthcare services for marginalized communities.

- Environmental Conservation: Enables efforts for wildlife protection and sustainable development.

- Social Welfare Programs: Helps in poverty alleviation, women’s empowerment, and rural development.

- Religious and Spiritual Endeavors: Encourages moral values and community service.

In short, Section 8 Company registration empowers those dedicated to positive societal impact with legal recognition and tax benefits.

What are the minimum requirement for Section 8 Company Registration?

To establish a Section 8 Company, certain conditions must be met:

- Minimum Personnel Requirement: At least two individuals (members/shareholders) are necessary.

- Directorship: Two directors are mandated for a Section 8 Company.

- Citizenship Criteria: One of the directors must be a citizen of India.

- Naming Convention: The company’s name should reflect its charitable nature, incorporating terms like Association, Foundation, Federation, Chamber, Electoral Trust, Council, or Forum.

- Financial Regulations: Members or directors cannot receive any remuneration, and profit distribution among members is prohibited.

- Compliance Obligations: Statutory audit, ROC filing, bookkeeping, and other regulatory requirements are mandatory.

In essence, forming a Section 8 Company requires careful adherence to these criteria to ensure its lawful and charitable operations.

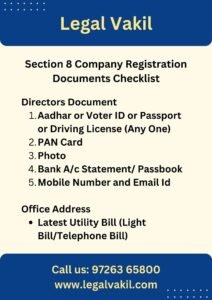

What are the Documents Required fo Section 8 Company Formation?

Following Documents required for Section 8 Company Registration Process

- PAN Card

- Aadhar Card

- Bank Statement of Director

- Photo

- Mobile and Email id

- Company Address Electricity Bill

- Nominee Documents – PAN Card, Adhar Card and Photo

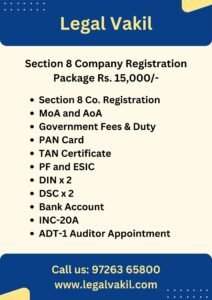

Our Section 8 Company Registration Package @Rs. 15000/-

We provide a comprehensive package for Section 8 company registration Consultancy which includes

- Registration of Section 8 Company

- Preparation of MOA

- Preparation of AOA

- Govt Fees

- Permanent Account Number (PAN) card

- Obtaining Tax Deduction and Collection Account Number (TAN) card

- Provident Fund (PF)

- Employee State Insurance Corporation (ESIC)

- MSME

- Director Identification Numbers (DIN)

- DSC-Digital signatures

- Bank account

- Filing of INC-20A

- ADT-1 Filing

Process of Section 8 Registration in India - Get Section 8 Company in 3 Days

Setting up a Section 8 Company is a streamlined process, ensuring quick formation within a span of just three days. Here’s a simplified guide to registration:

Step 1: Choose a Distinctive Company Name ending with “Foundation”, “Association”, “Federation”, or other indicative terms.

Step 2: Provide Us with Required Documents.

Step 3: Sign the Declaration and Obtain NOC.

Step 4: Draft the Memorandum of Association (MOA) and Articles of Association (AOA) for the Section 8 Company.

Step 5: Submit the Online Section 8 Company Registration Form via the MCA Portal.

Step 6: Receive the Section 8 Company Registration Certificate, along with PAN, TAN, ESIC, PF, and other necessary documents.

Step 7: Open the Bank Account for the Section 8 Company.

In a nutshell, the process of incorporating a Section 8 Company is straightforward, ensuring a swift and hassle-free registration experience.

FAQ's of Section 8 Company

We provide Company Registration Service Across India. Including Tier 1, Tier 2, and Tier 3 Cities. We are India best Section 8 Company Consultant.