How to Annual Compliance for Private Limited Companies in India

Welcome to our blog! How to Annual Compliance for Private Limited Companies in India? Keeping up with annual compliance is important to ensure your company stays legally safe, trustworthy, and avoids penalties. This includes key tasks like holding an Annual General Meeting (AGM), filing annual returns (MGT-7) and financial statements (AOC-4) with the Ministry of Corporate Affairs, submitting income tax returns, completing a statutory audit, and updating director KYC (DIR-3 KYC). Additional requirements may include filing GST annual returns (GSTR-9), TDS returns, payroll-related compliance (like EPF/ESI), and RBI filings if your company has foreign investments or loans.

Compliance also means keeping records updated, like meeting minutes and member registers, and following tax, labor, and corporate rules. Missing deadlines can lead to fines, legal trouble, and harm your company’s reputation. To make compliance easier, stay organized, use tools to track deadlines, and seek help from professionals like company secretaries or accountants. Staying compliant not only protects your business but also helps it grow smoothly and build trust with customers and investors.

Key Compliance Timelines for Private Limited Company

One-Time Compliance

ADT-1: Auditor Appointment

Within 30 Days of Company Incorporation

INC-20A: Business Commencement

Within 180 Days of Incorporation

Annual ROC Compliance

Holding of AGM

(Annual General Meeting) and Board Meeting

MSME

Filing of MSME-1 if MSME Creditors

MGT-7A

Annual Return

Within 60 Days of AGM

DIR KYC: Director KYC

Before 30th June Every Year

DPT-3

Deposit Return (Loan)

Before 30th June Every Year

MGT-14: Filing of Resolutions of Board Meeting

Within 30 Days of Board Resolution

AOC-4

Financial Statement Filing

Within 30 Days

Audit and Income Tax

Statutory Audit

Before 30th September Every Year

Income Tax Audit

Before 30th September (if applicable)

ITR Filing

Before 31st October Every Year

Event-Based Filing

Change in Directors

Change in Capital

Business Place Change

Auditor Resignation /Appointment

Loan/Charge Filing

Business Place Change

Cost of Annual Compliance for Private Limited Companies

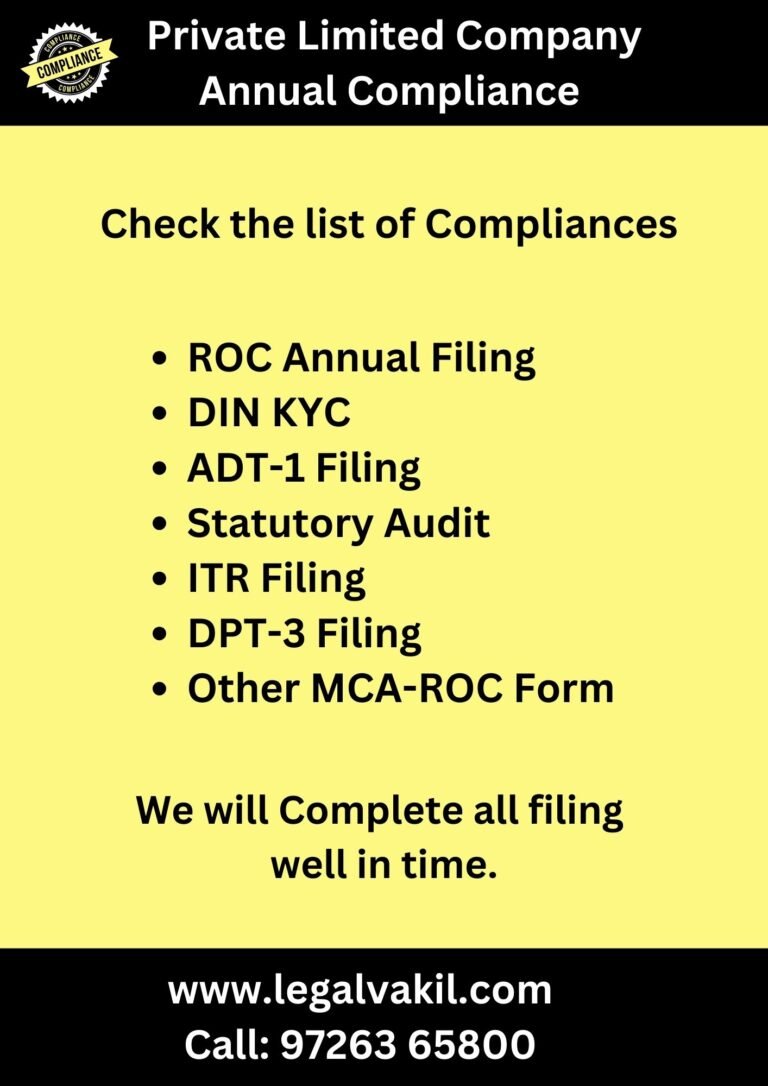

We are a leading Annual Compliance for Private Limited Companies in India Consultancy (CA) offering comprehensive Private Limited Company Compliance Services across India. Our affordable pricing for various compliance services is as follows:

- ROC Annual Filing (AOC and MGT): ₹5,000 (Professional Fees)

- DIN KYC: ₹1,000 per Director

- ADT-1 Filing: ₹1,000

- Statutory Audit: Starting at ₹10,000 (varies with turnover)

- ITR Filing: ₹2,000

- DPT-3 Filing: ₹2,000

- Other MCA-ROC Forms: ₹2,000 per form

We aim to provide reliable and cost-effective compliance solutions tailored to your business needs.

Get Expert Annual Compliance Services for Your Company

Reach out to our team for assistance with your annual filings and compliance needs. We will assess your specific requirements and provide a tailored list of compliances to ensure everything is completed efficiently.

We will create a detailed compliance checklist and request the necessary documents and information to initiate the compliance process seamlessly, ensuring accuracy and timely completion of all requirements.

Once we receive the necessary documents and details, we will promptly initiate the filing process. Rest assured, all filings will be completed within the stipulated timeframe.