Trust 80G Registration Consultant

Are you planning to start your NGO and need 80G Registration? We are trusted Trust 80G Registration Consultant offering specialized services for your NGO.

With our expert guidance, you can obtain your 80G Registration Certificate quickly and efficiently. Our simple, hassle-free process ensures that all the required documentation and filing are handled with precision. We help you navigate through the complexities of the process, ensuring compliance and enabling your NGO to receive donations, while donors can benefit from tax exemptions on their contributions.

Our team is dedicated to providing a smooth, reliable, and fast 80G Registration service, ensuring your NGO is well-positioned to attract donations from individuals, corporations, and under CSR schemes. Trust us to manage your 80G Registration with professionalism and ease.

Looking for Income Tax 80G Registration?

Rules and Regulations for Trust 80G Registration

Trusts seeking 80G registration under the Income Tax Act, 1961, must comply with strict legal and financial regulations to qualify for tax-exempt donations. The trust must be registered as a charitable entity under the relevant laws, ensuring that funds are exclusively used for public welfare activities like education, healthcare, poverty relief, and environmental protection. It must maintain proper financial records, undergo annual audits, and avoid profit-making activities. The application process requires submitting Form 10A or 10AB through the Income Tax e-Filing portal, followed by verification by tax authorities. Once approved, the 80G certificate remains valid for five years and must be renewed for continued compliance. For assistance with the application and to ensure adherence to all legal requirements, it is advisable to consult with an experienced Trust 80G Registration Consultant.

Eligibility Criteria for Trust/NGO 80G Registration

To qualify for 80G registration under the Income Tax Act, 1961, a Trust or NGO must meet specific legal, financial, and operational requirements. Below are the key eligibility criteria:

- Legal Structure – The organization must be registered as a trust, society, or non-profit company (Section 8 Company) under Indian law.

- Non-Profit Objective – The entity must be dedicated to charitable activities, ensuring that its primary focus is public welfare, not profit generation.

- Accurate Documentation – The organization must maintain financial records, proper books of accounts, and conduct an annual audit to comply with income tax regulations.

- Compliance with Statutory Requirements – It must adhere to Sections 11 and 12 of the Income Tax Act, ensuring tax-exempt status and compliance.

- Non-Exempt Business Income – The organization should not engage in business activities that generate taxable income. If business income exists, it must be accounted separately, and donations should be used exclusively for charitable purposes.

- Inclusive Approach – The organization must not restrict its benefits to a particular religious community or caste and should work towards broader public welfare.

- Darpan Portal Registration – NGOs applying for registration or renewal must register on the Darpan Portal of NITI Aayog, especially if they receive government grants or assistance.

- Audit Reports – If the NGO’s annual income exceeds the specified threshold under the Income Tax Act, its financial statements must be audited by a chartered accountant.

- Utilization of Funds – At least 85% of the organization’s income must be spent on charitable activities within India, ensuring funds are effectively utilized for the intended cause.

Meeting these eligibility criteria is crucial for obtaining 80G certification, which allows donors to claim tax deductions and helps NGOs secure more funding for their charitable work.

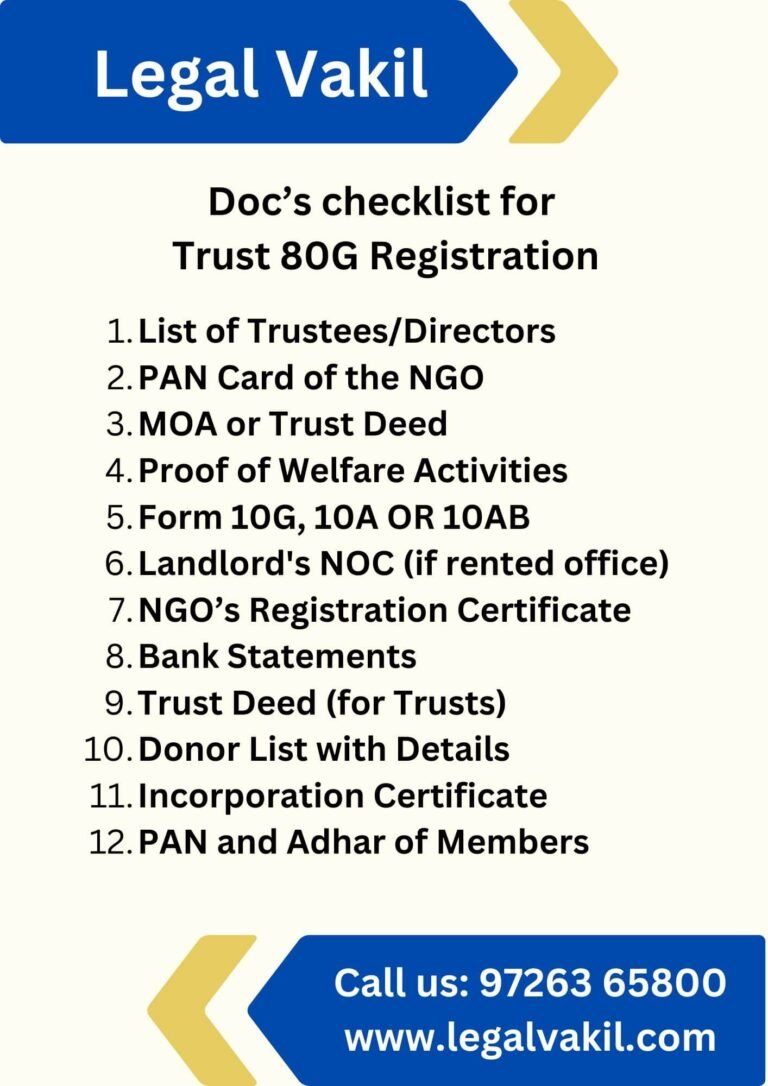

What are the Documents Required for 80G Registration?

Following Documents required for Trust 80G Registration Consultant

- List of Trustees/Directors/Board Members

- PAN Card of the NGO

- Memorandum of Association (MOA) or Trust Deed

- Proof of Welfare Activities being undertaken by the NGO

- Form 10G, 10A OR 10AB (Application form)

- Landlord’s NOC (if the office is rented)

- NGO’s Registration Certificate

- Bank Statements

- Trust Deed (for Trust-based organizations)

- Donor List along with their details

- Incorporation Certificate (for Society-based organizations)

- PAN Details of Trustees/Directors/Applicants

80G Registration: Fees and Payment Details

- Our Consultancy Fee: ₹30,000 (includes expert guidance, document preparation, filing, and follow-ups).

Complete Process for 80G Registration Explained

Application Filing

- Submit Form 10A (online or offline) to the Income Tax Commissioner in the relevant jurisdiction of the organization.

- Attach required documents such as the registration certificate, trust deed, audited financial statements, and details of activities.

Document Review

- The Income Tax Department evaluates the application to ensure it meets eligibility requirements, legal structure, and financial transparency.

Additional Documentation (if necessary)

- If further details are needed, officials will request additional documents, which must be submitted within the given timeframe.

Certification Issuance

- Upon approval, the Commissioner issues the 80G Certificate, allowing donors to avail tax deductions on their contributions.

Why 80G Registration is Important for Charitable Trusts

- Tax Benefits for Donors: Donors can claim tax deductions, encouraging more contributions.

- Increased Fundraising: Attracts more donors and larger donations due to tax exemptions.

- Credibility and Trust: Enhances the trust’s reputation and legitimacy.

- Transparency: Ensures proper financial records and compliance with laws.

- Sustainability: Provides stable funding for long-term charitable activities.

- Eligibility for Grants: Required for government and corporate funding opportunities.

- Promotes Philanthropy: Encourages a culture of giving by making donations tax-efficient.

80G registration is essential for boosting donor confidence, fundraising, and achieving the trust’s charitable goals.

How to Renew 80G Registration: Process & Validity Details

Validity:

- Provisional Registration: Valid for 3 years.

- Regular Registration: Valid for 5 years after provisional registration expires.

- Subsequent Renewals: Renew every 5 years.

Renewal Process:

- Prepare Documents: Gather trust deed, audited financials, PAN, and activity details.

- Submit Application: File Form No. 10A online/offline at least 6 months before expiry.

- Verification: Income Tax Department reviews the application and may request additional details.

- Respond to Queries: Provide requested information promptly.

Receive Certificate: Once approved, the renewed 80G certificate is issued, valid for 5 years.

Frequently Asked Questions About 80G Registration

The process typically takes 3 to 6 months, depending on the completeness of the application and the Income Tax Department’s verification process.

Yes, but without 80G registration, donors cannot claim tax deductions, which may reduce fundraising potential.

No, 80G tax deductions are applicable only to specific types of donations, such as:

Cash donations

Cheque or draft payments

Online transfers

Donations in kind (e.g., goods, services) do not qualify for 80G deductions.

Yes, a newly formed trust or NGO can apply for provisional 80G registration within one year of its establishment. Provisional registration is valid for three years, after which the organization must apply for regular registration.