Trust Registration Service

Looking to register a Trust? You’re in the right place! At Legal Vakil, we specialize in providing Trust Registration Services for NGOs and charitable organizations. Our expert team guides you through every step of the registration process, from understanding the legal requirements to completing the necessary documentation and ensuring compliance.

Whether you’re aiming to create a trust focused on education, healthcare, research, social welfare, or other causes, we’re here to help. With our consultancy, you can start your trust smoothly and with full legal support.

Interested in Trust Registration? Let’s Guide You

How to Register a Trust: A Detailed Overview

A trust is created by individuals to allocate a portion of their assets or property for the benefit of another person or group. This involves a fiduciary relationship between the trustor, the trustee, and the beneficiary. The specific terms and conditions of this relationship are outlined in the trust deed, which is submitted during the registration process.

The process of establishing a trust occurs when the trustor transfers specific assets or property to the trustee, who then manages and utilizes these assets for the benefit of the beneficiary. The beneficiary is generally a third party who has a direct connection with both the trustor and the trustee.

The dynamics of these relationships are essential in defining the trust. According to the Indian Trusts Act of 1882, a trust is a legal relationship where the trustor and trustee work together to hold and manage assets for the ultimate benefit of the beneficiary.

Eligibility Criteria for Trust Registration

The following are the key eligibility criteria for registering a trust in Gujarat:

- Charitable Purpose: The trust must have a clear charitable intent, such as social welfare, education, healthcare, or other non-profit objectives.

- Minimum of Two Trustees: The trust must have at least two eligible trustees.

- Sound Mind and Legal Capacity: Trustees should be of sound mind and legally capable of managing trust affairs.

- Age Requirement: Trustees must be adults, typically 18 years or older.

- Criminal Background: Trustees must not have any criminal history.

- Local Residency: At least one trustee must reside within Gujarat.

- Consent of Trustees: All trustees must provide their consent for their appointment.

- Non-Profit Objectives: The trust’s objectives should be genuine, non-commercial, and focused on public welfare.

- Sufficient Funds: The trust should have adequate funds to support its activities and fulfil its objectives.

- Legal Compliance: The trust must comply with all applicable legal regulations.

- Clear and Inclusive Objectives: The trust’s goals should be clearly defined and non-discriminatory.

What Are the Different Types of Trusts for Registration?

- Public Trust: Created for charitable, educational, or religious purposes to benefit the general public.

- Private Trust: Established for the benefit of specific individuals, families, or close associates.

- Public Cum-Private Trust: Serves both public and private purposes, benefiting both the general public and specific individuals.

- Private Limited Trust: Operates for the benefit of a specific group or family, governed by the Indian Trusts Act of 1882.

What Are the Costs of Trust Registration

Our Trust Registration Package Includes:

Consultancy Charges: ₹25,000/-

- Trust Deed Preparation

- PAN Card for the Trust

- Bank Account Opening

- Registration with Charitable Commission/Society

Process for Application for Trust Registration

Step 1: Consultation and Document Collection

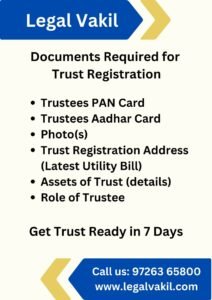

Consult with our experts to understand the trust registration process. Choose a unique name for your trust and gather all necessary details. Collect essential documents, such as identity proofs and address proofs of trustees.

Step 2: Trust Deed Drafting

Our legal experts will draft a trust deed based on the Indian Trusts Act and state-specific regulations. The deed will be customized to reflect the trust’s specific objectives and goals.

Step 3: Application Submission

Submit the finalized trust deed along with the required documents to the relevant authorities for registration.

Step 4: Verification and Follow-Up

We will assist in addressing any queries or additional requirements that arise during the verification process.

Step 5: Registration and Certification

Once verified and approved, you will receive the trust registration certificate from the Sub-Registrar’s office.

Step 6: PAN and Bank Account Setup (Optional)

If required, we will help you apply for a PAN for the trust. Additionally, we can assist in opening a bank account in the trust’s name using the registration certificate.

The Benefits of Trust Registration Explained

- Charitable Impact: Benefit beneficiaries and society through charitable activities.

- Tax Exemptions: Enjoy tax benefits under the Income Tax Act.

- Financial Support: Provide aid to the underprivileged.

- Legal Protection: Safeguard the trust under the Indian Trusts Act of 1882.

- Wealth Protection: Manage and preserve family assets.

- Avoid Probate: Transfer assets without the need for probate.

- Immigration Benefits: Manage taxation and safeguard assets when relocating.

Registering a trust offers legal, financial, and asset management advantages.

FAQs on Trust Registration Services

Registering a trust provides legal recognition, ensures compliance with laws, enables tax benefits, and helps in managing funds for specific charitable or welfare activities.

Yes, the trust deed can be amended with the consent of all trustees, but the changes must be formally documented and compliant with legal requirements.

While it is not mandatory to register a trust, registration provides legal benefits, tax exemptions, and credibility, which are essential for managing a charitable trust effectively.

Yes, a trust can operate in multiple states or countries, but it must comply with the laws of each jurisdiction.